Season 1 Episode 5 is about George discovering a stock tip from a friend (Simon) of a friend (Wilkinson), who has made millions off it already. George attempts to convince Jerry to go in with him on "Sindrax". Jerry asks, "what do they do?" "They have revolutionized a way to televise the opera better," proudly replies George and adds, "it has gone up 3 points already!". Plus, he tells Jerry his informant (Wilkinson) will tell him when to sell. Jerry caves in to George's peer pressure and buys the stock with George.

Buy Low & Sell High, Jerry

What follows is a nervous Jerry constantly checking the stock price everyday only to see it go down. In addition, George's informant has mysteriously vanished only to be tracked down at a hospital. In a matter of days, 60% of his capital is wiped out. Despite his girlfriend telling him the market fluctuates, he says, "I've been fluctuated out of all my money!" Jerry decides to sell his shares to get it out of his mind while he goes on vacation with his girlfriend in Vermont. George stubbornly says he "will go down with the ship." While on vacation Jerry sees the stock has shot way up. George cashes in on his tip treating Jerry and Elaine to dinner while touting around a cigar.

Ah, mistaking luck for skill

As the episode ends, George whispers to Elaine and Jerry about a new stock tip he has received about a company that is planning on releasing a robot butcher...

Castles In the Air

---------------------------------------------------------------------------------

Yen, the Drunk Driver of the Markets

The Yen is taking a beating. USDJPY down 6% since May 22nd. No new news here: when the Yen shows volatility the markets struggle. The Yen's problems arise from shorts and options covering, the volatile nature of the Japan Bond Market, and the market realization that Nikkei is not somewhere you want to park your money. The market is struggling to find where to park their money explaining the volatility we see across all stock indices, currencies, and bonds. The smart money is following the dollar already parking it in US Equities with Emerging Market- and Commodity-linked securities seeing money pour out which the media is starting to catch on now. Everybody is an expert once something has already happened.

However, the Japanese policy is still to inflate and to debase their currency. They will go down with the ship. You can not have real growth with a weak currency just inflation. In fact, the BOJ is not reaching their inflation target as quick as they expected. It did not happen here in the U.S. and it will not happen anywhere, including Japan.

The earliest Fed tapering forecasts are in late 2013 with the consensus being roughly mid 2014. The market is pricing in the tapering already. If the Fed does not taper quick enough the fact that the Balance Sheet of the BOJ is increasing at a faster rate the past year at 17.65% compared to the Fed's 1.65% is a way of tapering.

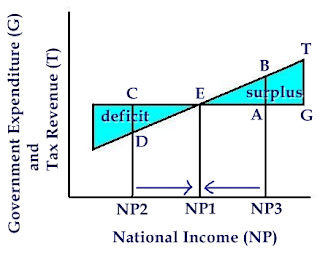

Sorry Mom & Dad, Going to Have to Stay At Home for a Bit

Another issue is Youth Unemployment. The Youth are unskilled workers so when the minimum wage is raised the Youth Unemployment also increases, as seen below. Not only are the youth not picking up valuable experience in the workplace, they remain in the unskilled labor pool due to A.) minimum wage discourages businesses from hiring B.) the Youth when they go on to graduate from college are riddled with debt and forced to take a lower paying job such as waiting tables, bar-tending, etc. to pay off their student loan debts and therefore, sacrifice future earnings potential making the college degree unnecessary. Unskilled workers are among the first to go during hard times because they are dispensable. When you have a minimum wage increase during rough periods such as in '07-'09, '90-'91, Mid-70s, and Early 80s it amplifies the Youth Unemployment rate further, as seen below.

Europe for Comparison:

Only Great Britain (U<25UK) is on the down-trend. Germany (U<25GR) & Euro Area (U<25EMU) are flattening Italy, Spain, France are all heading up.

Until next time,

David Talbott