Question 1:

i.) Macroeconomics is the study of the economy as a whole examining trends in things such as GDP, Unemployment, Trade Balance, etc.

ii.) Macroeconomics looks specifically at what the economy is doing at a particular time period.

iii.) Macroeconomics is the study of the economy on an individual basis looking at consumers and firms

(A.) Only Statement iii is True

(B.) Statements i and ii are True

(C.) Only Statement ii is True

(D.) Only Statement i is True

(E.) All of the above Statements are False

Correct Answer: (D.)

I put (B.) because I am an idiot.

The reason I put that little tidbit in there is to a) poke fun at myself b) show how much I've grown from an undecided major who did not know the difference between macro and micro to a chart wielding nerd and c) be a little responsible to say, "hey, I do make (many) mistakes, but I do not make em again," which are coincidentally the same reasons I am writing this blog - an open journal of a few victories, many mistakes, and a story of a kid striving to be a better analyst, researcher, & trader but most of all: a better person.

--------------------------------------------------------------------------------

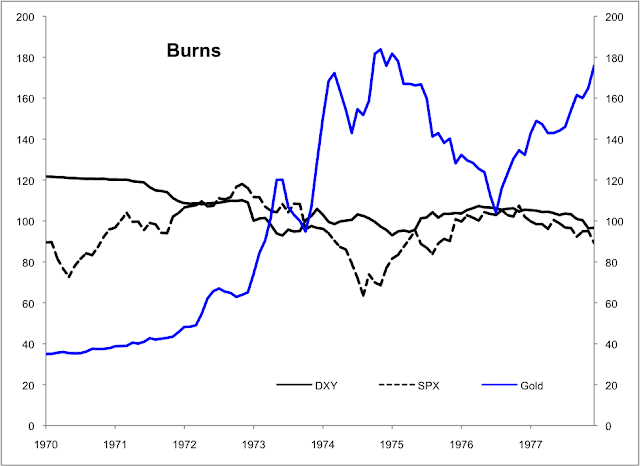

Anyway, below is the performance of the US Dollar, S&P, and Gold broken up by each of the fed chair head's tenure from Burns and on to 4/30/2013 Bernanke.

Arthur Burns: 02/1970 - 03/1978

Burns is the man if you own Gold and anything commodity linked. He makes Bernanke seem like an inflation hawk! That is scary. A 400% jump in the price of Gold from his first month in office in 1970 and till the end of his reign 1978.

George William Miller: 03/1978 - 08/1979

Paul Volcker: 02/1979 - 02/1987

Volcker is the man! After dealing with inflation and the tail end of the energy crisis he kicked Gold's butt for 8 years. From the peak of Gold prices in the early 80s, Gold depreciated 30.6% He and Greenspan's tenures saw some of the best USD and GDP growth numbers ever!

Alan Greenspan: 08/1987 - 01/2006

Greenspan is the one that stands out of all the Fed Chairman. He seems to have bipolar monetary policies. Under Reagan, Bush Sr, and Clinton administrations, he is PRO Dollar and Growth. The USD went up 4.6% from his first month in office to end of 1999 while the S&P (with some bubble help) jumped 483%! Gold, on the other hand, dropped 36.48% in that same span. Then under Bush Jr administration he loses his mind after the Dot Com Bubble and turns into a PRO Gold and Inflation kind of guy. Gold went up 97.5% from January 2000 until he stepped down in early 2006. With inflation rocketing the Dollar took a hit of -15.38%. The stock market normally absorbs some inflation; however, the S&P dropped 8.2% trying to recover from the Dot Com Bubble. Maybe instead of everyone throwing their money at the stock market, they decided to invest in real estate....?

Ben Bernanke: 2/2006 - Present

What can I say about Bernanke? Although, lately, he is backing off the Dollar. Just get out of the way, Ben! Taper some more to pop that bond market further.

Nice little summary of the overall performance of the S&P, the Dollar, and Gold under the Fed Chairmen:

SPX

|

DXY

|

Gold

|

|

Burns

|

9.48%

|

-25.6%

|

402.29%

|

Miller

|

16.37%

|

-6.96%

|

63.24%

|

Volcker

|

191.49%

|

14.45%

|

46.78%

|

Greenspan

|

408.39%

|

-8.67%

|

25.47%

|

Bernanke

|

23.38%

|

-9.28%

|

162.97%

|

No comments:

Post a Comment